Is the USA the next Spain?

By Luis Manuel Muñoz Escobedo, Actinver Brokerage House.

The dislike most societies have for debt comes from a historical perception of debt being immoral or shameful. In William Shakespeare’s the Merchant of Venice (1596), Bassanio is profoundly embarrassed at having to ask Shylok for a loan. Christian society considered lending money at interest a sin until the advent of the Medici family during the Renaissance. The origins of the words debt and deficit come from the Latin root deficiens which means “to lack”. The words themselves have a negative connotation and people instinctively regard them as bad. The truth is that debt is a crucial part of any nation’s development and the amount of leverage a nation can assume is a function of its GDP and its credit worthiness as understood by the market.

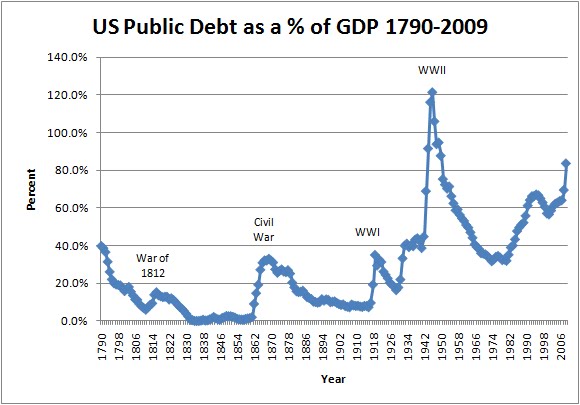

Is the US the next Spain? Well… no… The reason is very simple; the burden of debt cannot be measured as its nominal value. This approach does not consider inflation, but worse, it does not consider GDP growth. Think of it this way, if you currently earn $1000 USD a month and you borrow $100 you have a 10% leverage. If after a few years you earn $2000 USD a month and you borrow $200 USD, the amount of your debt has increased, but as a percentage of your income it has not. This simple example shows why when considering if a person or county is to highly leveraged, you need to compare it to its income or GDP.

Currently, the US debt to GDP ratio is around 100% which is not even close to its historical peak during World War 2. Just as industries such as mining require high leverage to operate without this being understood as a bad thing, each country has a variable acceptable debt ratio. What really defines how much debt a country can issue is the cost of the debt, not its nominal value. In the particular case of the US, not only is the cost of debt low, it is at historical lows. Currently, the USA issues 10 year notes at under 2% and the cost of servicing all US debt is only 1.7% of GDP.

If you consider Spain’s dilemma carefully, you will note that the root of the problem is not the amount of debt but the cost of it (currently at 5.12%). The problem with socialist economies is not that they incur in debt (the US is far from socialistic if compared to most western European economies and still has plenty of debt) but that they distort the incentives that economic entities have to work and innovate. The result of a socialistic government is a general lack of incentive which eventually builds up in the government’s balance sheet which is obliged to spend ever increasing amounts on welfare systems which create no direct or indirect economic benefit. This constant increase of debt to fund unproductive ventures eventually leads to collapse via ever increasing debt costs.

Is there an unsustainable debt level for the US? I am sure there is, but right now we are not even close to it as evidenced by the historical low interest rate the market places on US debt. As of today, the US is in no danger of defaulting and its debt burden, contrary to popular opinion is very manageable. Although the government of the USA must take measures to control its deficit spending, the situation is far from critical and despite the media constantly supporting the gloom and doom view, a revision of historical data proves that when the debt to GDP ratio hit historical peaks, periods of economic growth tend to follow.